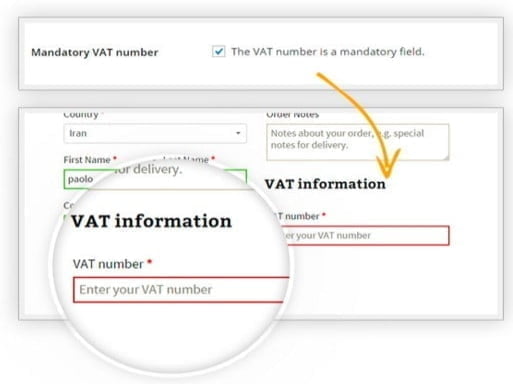

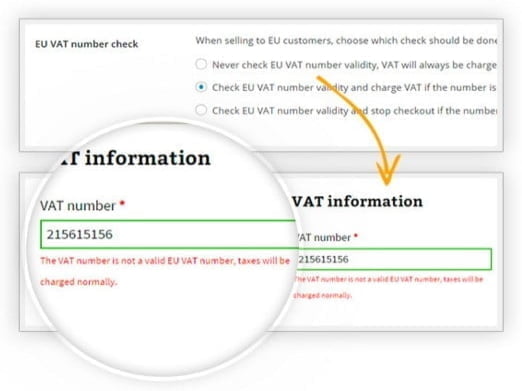

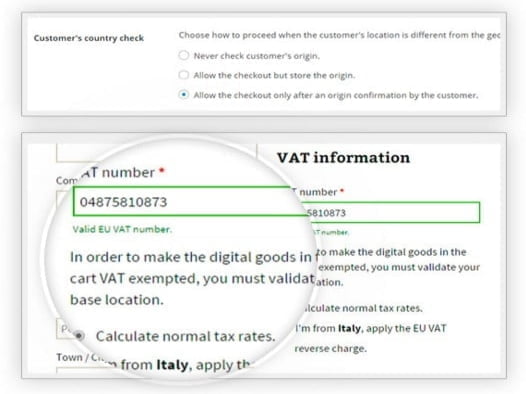

On January 1, 2015, the European Union entered into force new rules on taxing the purchase of digital goods (software, electronics, e-book, telecommunications and broadcasting services) for European citizens. For consumer sales, the store must apply the VAT of the buyer's country. In business, it all depends on whether the company has a valid VAT number recognized by the European Union. 28 countries mean 28 different calculations. Do you think this could be confusing? Well, because with YITH WooCommerce EU VAT everything will be automatic.

As an e-commerce owner, you should be aware of the new European digital goods rules. In fact, the European Union has chosen to apply the buyer's country VAT to B2C (business to consumer) sales. On the contrary, for B2B (business to business) sales, if the company has a valid VAT number, the purchase will not be charged any VAT, otherwise the VAT that will be applied would be the same as for B2C sales.